First Day Of The Calendar Year For Taxes

First Day Of The Calendar Year For Taxes – Typically percentage of an individual’s or company’s taxable income, income tax is routinely submitted annually to the government. The income tax rate undergoes variation based on the income amount . Tax compliance is crucial for individuals and businesses alike, ensuring adherence to legal obligations and avoiding penalties. The month of June 2024 brings forth a myriad of tax compliance .

First Day Of The Calendar Year For Taxes

Source : www.investopedia.com

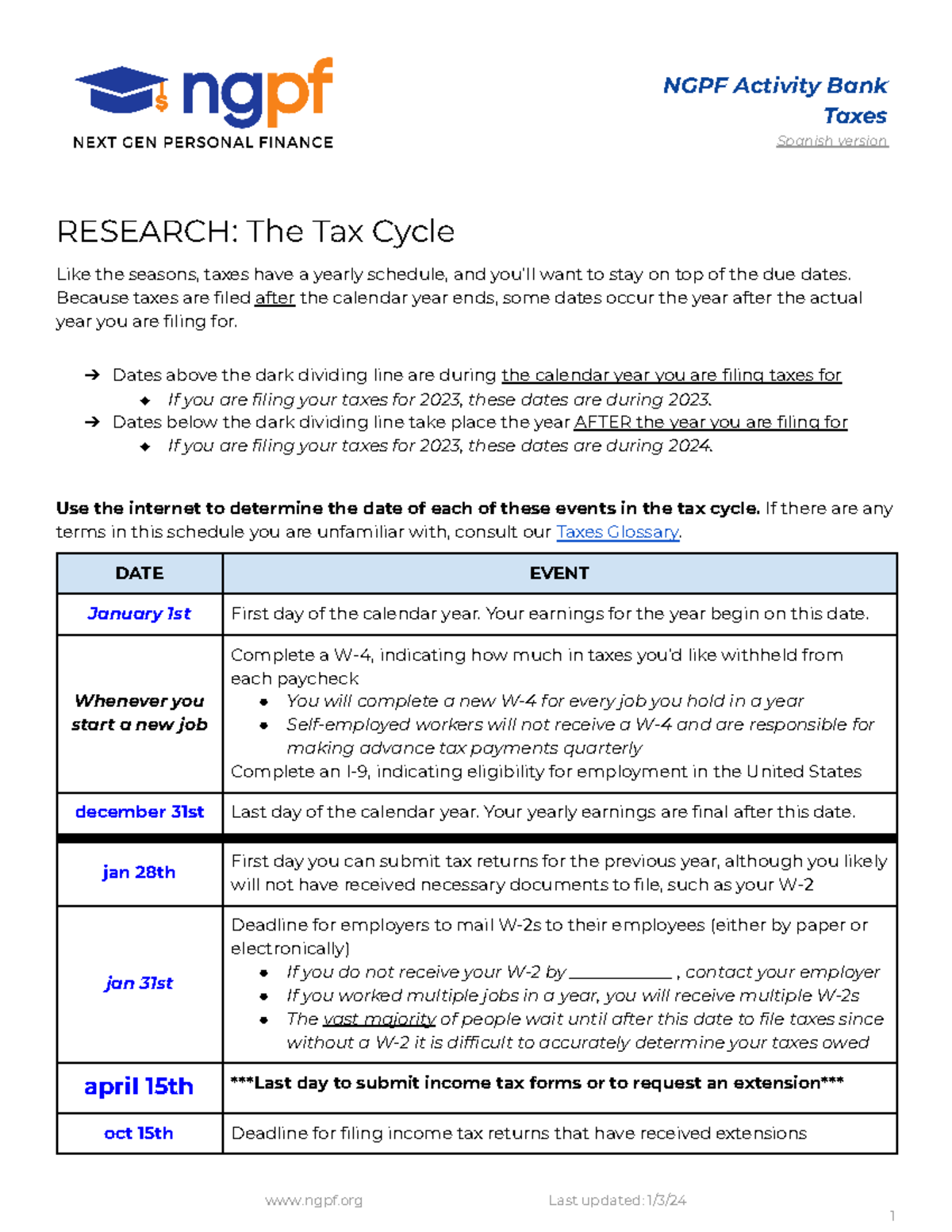

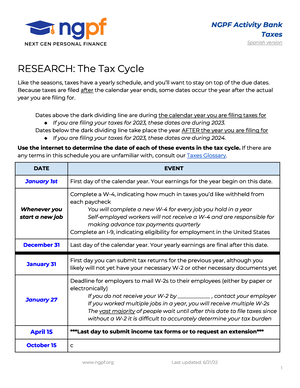

use the Interto determine the date of each of these events in

Source : brainly.com

Year to Date (YTD): What It Means and How to Use It

Source : www.investopedia.com

Taxes 1.3 Research The Tax Cycle NGPF Activity Bank Taxes

Source : www.studocu.com

Fiscal Year: What It Is and Advantages Over Calendar Year

Source : www.investopedia.com

Copy of Research The Tax Cycle NGPF Activity Bank Taxes Spanish

Source : www.studocu.com

1st January is first day of new year. Wooden vintage calendar with

Source : www.alamy.com

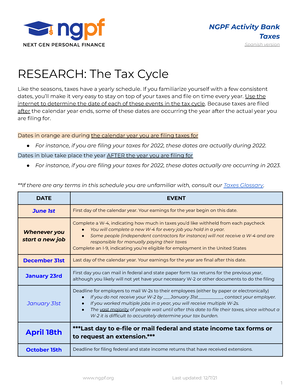

Research The Tax Cycle ngpf Last updated: 6 / 21 / 22 1 NGPF

Source : www.studocu.com

Need Help California LLC Annual Fee What year do I select when

Source : www.reddit.com

use the Interto determine the date of each of these events in

Source : brainly.com

First Day Of The Calendar Year For Taxes What Is the Tax Year? Definition, When It Ends, and Types: *These due dates are subject to extension as per government orders at a later date. **UPDATE: The due date of ITR filing for businesses (subject to audit) has been extended to October 31, 2019. The . Your article was successfully shared with the contacts you provided. The Tax Relief for American Families and Workers Act of 2024, H.R. 7024, which includes 100% bonus depreciation and other tax .

:max_bytes(150000):strip_icc()/taxyear-c3f5618cd504499583b0543cb4d6b31e.jpg)

:max_bytes(150000):strip_icc()/YTD-V2-2a43c52527b840ee946b51e2efeb1a4c.jpg)

:max_bytes(150000):strip_icc()/FY-887c7c1cad1c47f38bd91db6e080b68e.jpg)